SECU, or State Employees' Credit Union, provides an online platform for its members to access their accounts and manage their finances conveniently. The SECU login portal serves as the gateway to a host of banking services, allowing members to securely sign in and view their account balances, transaction history, transfer funds, pay bills, apply for loans, and more. To access their accounts, users typically need their unique username and password, ensuring the confidentiality and security of their financial information.

SECU employs robust encryption and security measures to safeguard sensitive data, offering peace of mind to its members while conducting online banking activities. The login interface is user-friendly, designed to provide a seamless experience across various devices, enabling members to easily navigate and access the array of financial services offered by SECU. Additionally, SECU's login portal often includes multifactor authentication options to further enhance security, ensuring that only authorized individuals can access the accounts.

Contents

How to Access My SECU Login Online Account

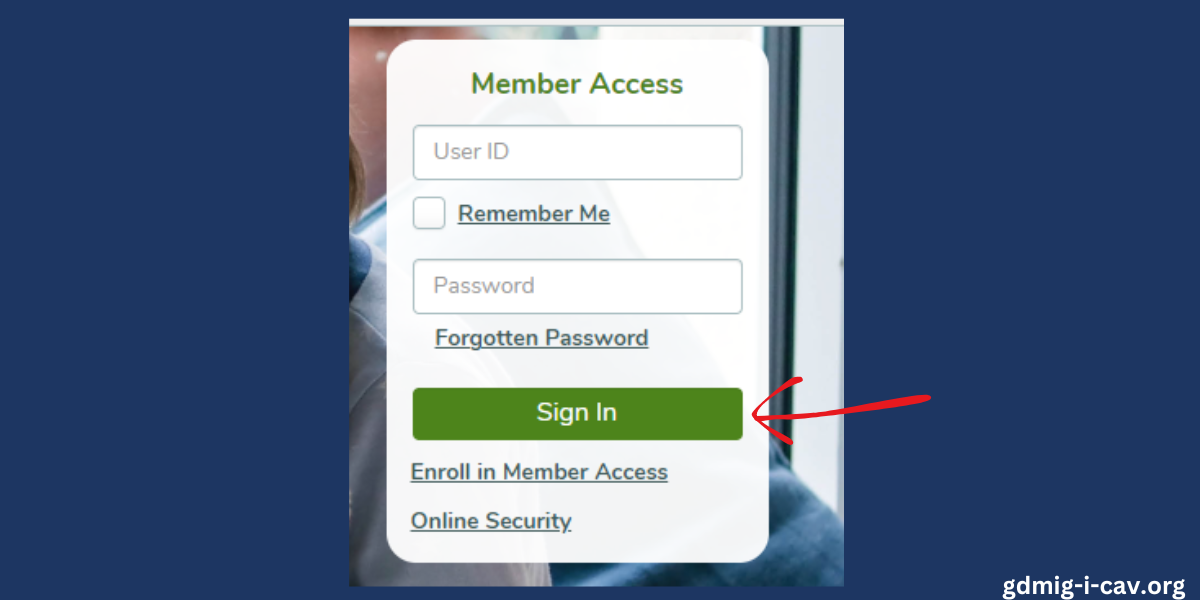

- Visit the SECU homepage at ncsecu.org.

- Locate the ‘Member Access' section on the right-hand side of the page.

- Enter your unique user ID into the designated space provided.

- Input your account password into the box below the User ID field.

- Once your credentials are entered, click the ‘Sign In' button to access your SECU member account.

Step-by-Step Instructions for SECU Login Forgotten Password Process

- Navigate to the login page: Go to the SECU login page, where you usually enter your credentials.

- Find the Forgotten Password Link: Look for a link or button that says "Forgot Password," "Forgotten Password," or something similar. This is typically located near the login fields.

- Verification of Identity: Click on the forgotten password link. You will likely be asked to provide your username or account number to verify your identity.

- Security Questions or Email Verification: The system may ask you to answer security questions that you set up when you created your account. Alternatively, it might send a verification link or code to your registered email address or phone number.

- Reset Your Password: Once your identity is verified, you will be prompted to create a new password. Make sure to create a strong password that is difficult for others to guess.

- Confirmation: After setting up the new password, you will typically receive a confirmation message, either on the website or via email, confirming that your password has been changed.

- Log in with a new password. Return to the login page and try logging in with your new password to ensure the process was successful.

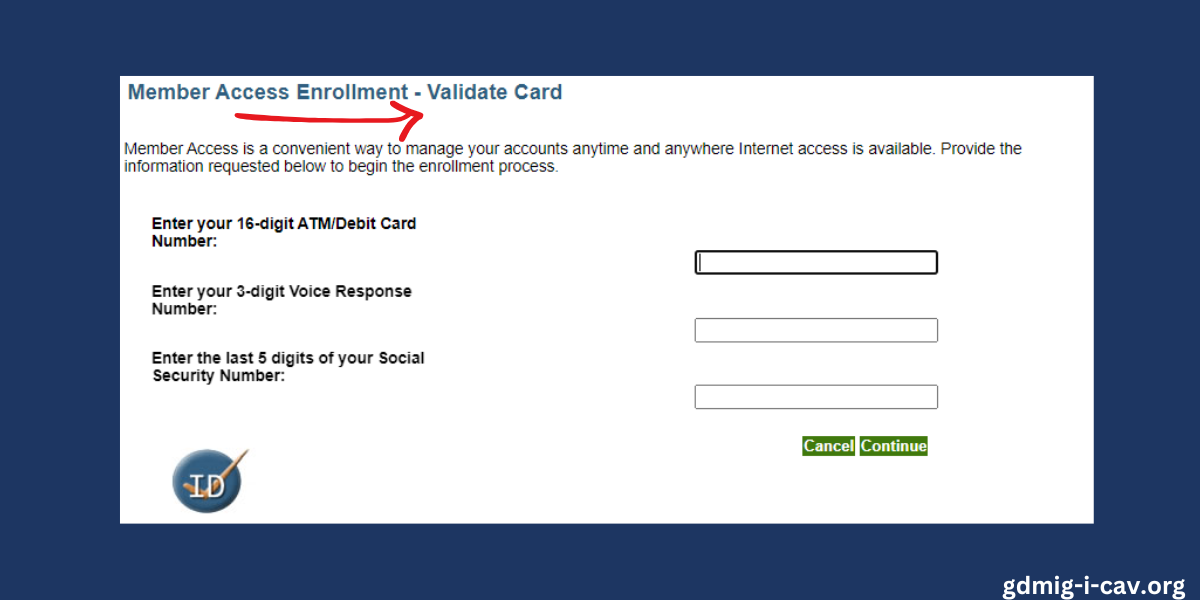

Steps for Online Enrollment in SECU Financial Services

What you will need to enroll in:

- 16-digit ATM/Debit card number

- 3-digit voice response number

- For the best user experience, please view our browser requirements

- Access the Enrollment Page: Navigate to the official website of the financial institution. Look for an enrollment option, which is often labeled "Enroll," "Sign Up," or "Register."

- Select Account Type: Choose the type of account you wish to enroll in, such as personal, business, or other specific account types offered by the institution.

- Enter Personal Information: You will likely be asked to provide personal information such as your name, social security number, date of birth, and contact details. This is to verify your identity and set up your profile.

- Provide Account Information: Enter details of your existing account with the institution, if applicable. This could include account numbers, card numbers, or other relevant information.

- Set Up Security Features: Create a username and password for your online access. You may also be asked to set up security questions and answers for additional account security.

- Verification Process: The institution may require you to verify your identity through an email link or a code sent to your phone.

- Review and Accept Terms: Carefully read the terms and conditions of online access and accept them if you agree.

- Confirmation of Enrollment: Upon successful completion of these steps, you should receive a confirmation message indicating that your enrollment is complete.

- First-time Login: Attempt to log in to your account using the credentials you set up to ensure that the enrollment process was successful.

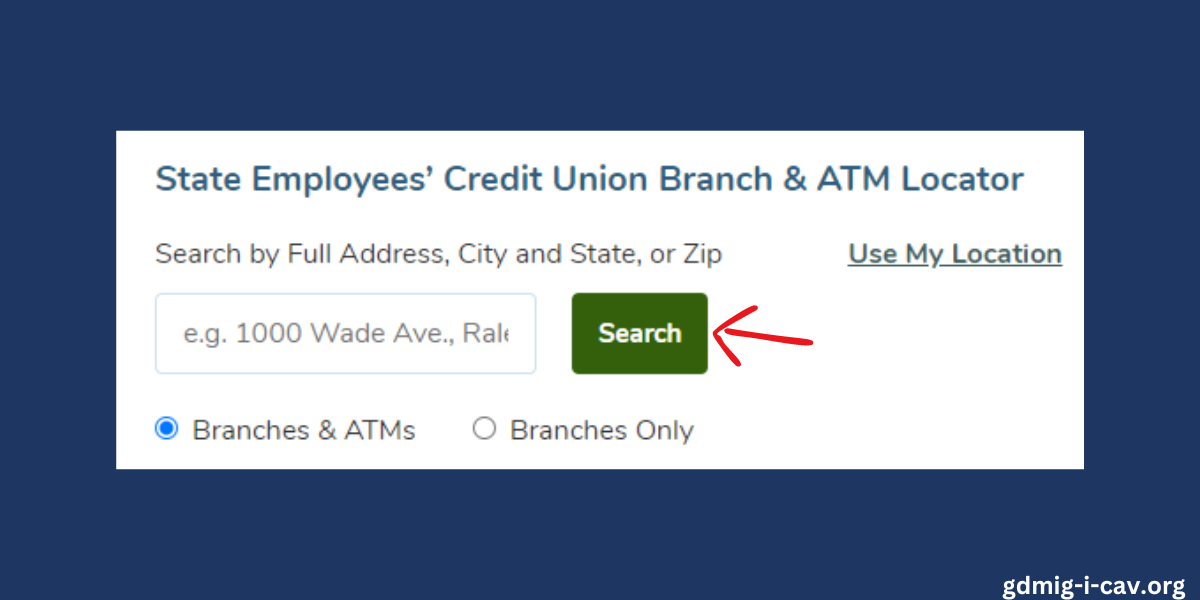

Step-by-Step Instructions for Using SECU Branch & ATM Locator

- Access the Locator Tool: Visit the SECU branch and ATM locator page at SECU Branch & ATM Locator.

- Search Options: You have multiple options for conducting your search:

- By Full Address: Enter a complete address, including street, city, and state.

- By City and State: Input the city and state where you are looking for a branch or ATM.

- By Zip Code: Simply enter the zip code for the area of interest.

- Use My Location: For a quick search based on your current location, select the ‘Use My Location' option. This requires allowing the website to access your location data.

- Select Location Type: Choose what type of location you are looking for:

- Branches & ATMs: This option will show both branches and ATMs.

- Branches Only: Select this if you are specifically looking for SECU branches.

- Initiate Search: After entering your preferred search criteria, click on the “Search” button to view the results.

- Review Results: The search results will display a list of nearby SECU branches and ATMs based on the information you provided. Each result will include details such as the address, contact information, and services offered.

- Select a location for more details: Click on a specific location to get more detailed information, such as opening hours, specific services available, and directions.

FAQs about SECU Login

1. How do I open an account with SECU?

- To open an account with SECU, you must be eligible for membership, which typically includes state employees, public school employees, and their family members. Visit a local branch or the SECU website to start the application process, providing the necessary identification and documentation.

2. What types of accounts does SECU offer?

- SECU offers a variety of accounts including savings accounts, checking accounts, certificates of deposit (CDs), Individual Retirement Accounts (IRAs), and money market accounts. They also offer various loan and credit options.

3. How can I access online banking with SECU?

- To use SECU’s online banking services, you need to enroll in their online access program. This can be done through their website by providing your member number and following the enrollment process, which includes setting up a username and password.

4. What should I do if I lose my SECU debit or credit card?

- If you lose your SECU debit or credit card, report it immediately to SECU. You can do this by calling their customer service line. They will assist you in blocking the lost card and issuing a new one.

5. How can I find the nearest SECU branch or ATM?

- You can find the nearest SECU branch or ATM by using the branch locator tool on their website. Enter your zip code, city, or full address to find the closest locations.

6. Are there any mobile banking options available with SECU?

- Yes, SECU offers mobile banking through their mobile app, which is available for both iOS and Android devices. The app allows you to check balances, transfer funds, pay bills, and more.